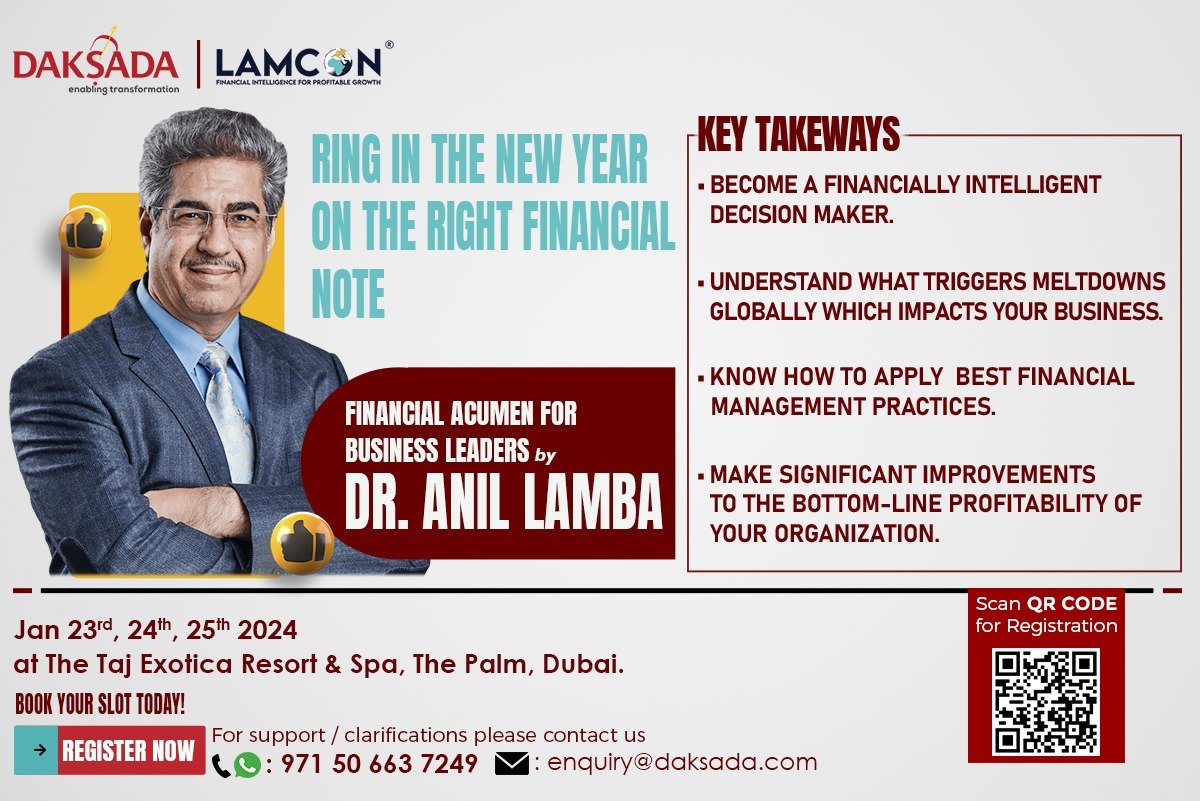

Daksada, in partnership with LAMCON, is proud to bring to you the “Financial Acumen for Business Leaders” a 3-Day exclusive program for Entrepreneurs, Business Owners, CXOs and Business Leaders with Dr. Anil Lamba. The program venue for would be the Taj Exotica Resort & Spa, The Palm, Dubai, a distinctive island oasis gently rising from the iconic Palm Jumeriah surrounded by the white sands and the warm waters of the Arabian Sea.

Don’t miss this opportunity to learn from one of the most respected names in the finance industry. Empower yourself to take financially intelligent decisions to generate sustainable profits for your business.

Dr. Anil Lamba is a renowned financial literacy advocate, author, and educator with a wealth of experience in simplifying complex financial concepts for audiences worldwide. He has authored multiple books, conducted workshops in over 25 countries, and worked with prestigious organizations to deliver financial education that empowers individuals to make informed financial choices.

Appreciation of the key financial statements – Profit and Loss Account, Balance Sheet, and Cash Flow Statement. Taking a fresh look at the terms that we use in our daily operations.

Join the movement to create Financially Intelligent Organizations.

Workshop Summary

Getting the Basics Right

a. Managing Profitability Since the objective of any business enterprise is to generate profits, the session will focus on the concept of profit. In this session, we’ll explore profits and managing profitability– the goal of every business. we’ll delve into how the entire team contributes towards making profits and understanding EVA (Economic Value Added) along with determining how much profit is sufficient.

b. Effective Cash Flow Management It is an established fact that most business failures are caused by financial mismanagement. It is therefore imperative for an organization to survive and prosper that ‘Good Finance Management’ is practised at all levels across the organization. This session will therefore be a discussion on the importance of effective cash-flow management for long-term sustainability.

Requisites of Healthy Business

The world intermittently witnesses recessions and only the fittest survive in the aftermath.

Recession

In this module we focus on what triggers meltdowns – What is recession, what are its causes, what is its impact; what is inflation, , deflation, GDP. We also focus on what strategies can help mitigate the severity of impact of such meltdowns on your organization.

b. Interest Rates

What do interest rates do? What is their impact on your business strategies. How can the trends be better leveraged to create better strategies?

Financial Decision Making

This session empowers participants to take Financially Intelligent decisions. It enables participants to work out ‘Break-Even Points’ for their businesses / projects, set targets for achieving sales, determine pricing policy, take marketing related decisions, understand the impact on profitability of decisions pertaining to credit given to customers, discounts offered etc.

Evaluation of Financial Performance

a. Leverage Analysis

How Fixed costs can be used to magnify returns to owners is explained in this session Also covered is the impact of borrowing on profitability, how to maximise profitability by using leverages to one’s advantage and the use of leverage analysis to understand how safe or at risk an organization is.

b. Ratio Analysis

Ratio Analysis is a powerful tool and helps in inter and intracompany analysis and in ensuring that the organization is performing within industry norms, and if not, the steps to be taken to do so.

Need more information ?

Forecasting Need and Funds Availability

Effective budgeting helps in ensuring a reasonable balance between outflow and inflow of funds so that stability is maintained This session will cover the process of framing objectives, policies, procedures, programmes regarding the financial activities of a concern and forecasting the need and availability of funds to achieve those objectives. The objective is sufficient funds should be available at the time they are needed with optimal arbitrage cost for acquiring the funds.

Making Capital Investment Decisions

In this session we will discuss the Net Present Value method of evaluating projects and will clarify terms like Discounted Cash Flow, Internal Rate of Return etc.

The session focuses on determining capital requirements (cost of current and fixed assets, promotional expenses and long- range planning) and the organization’s capital structure. It discusses how to frame financial policies to ensure that the scarce financial resources are utilized in the best possible manner, at least cost, to get maximum return on investment.

Funds Flow Statement

This session focuses on how to evaluate the health of a business through the interpretation of the Funds Flow Statement. The objective of this session is to understand how this statement enables you to get an insight into the happenings within an organization, understand where the money has gone and whether it has been put to right use

Evaluating Business Health

A case study

This session will be explored through a case study where the participants will be expected to evaluate the health of an organization using a funds flow statement in a group discussion exercise. The participants will also get an opportunity to test the practical application of all the principles that they have learnt during this workshop.

Join the movement to create Financially Intelligent Organizations.

This workshop is designed to give Entrepreneurs, Business Owners, Business Leaders, and CXOs such as yourself, a learning experience that will enhance your financial acumen to manage the bottom-line profitability & create a financially intelligent organization.

Join the movement to create Financially Intelligent Organizations.

- 3525 Per Participant

(Exclusive of 5% VAT)

- 23rd, 24th, 25th Jan 2024

- The Taj Exotica Resort & Spa, The Palm, Dubai, UAE

Seats are limited and are allocated on “First Come, First Served” basis.